The mark has been steady for three years now.

By Beth Bellor

CPA Trendlines Research

April 15 has come and gone. Finally, tax season is over!

Hahaha! Sure, it’s true for the 140 million+ represented on the returns filed so far, but it doesn’t speak to their neighbors who aren’t quite there yet. You know, the ones you filed extensions for.

MORE: Tax Refunds Up About 4% | Tax Pros Own 53% of E-filings | Tax Stats Still Playing Catchup | Tax Pros Take the Edge in E-Filings | Tax Pros Gain Ground, and DIYers Maintain Lead | Tax Pros Handle 46.4% of E-filing | Tax Refunds, Tax Pro Market Share Trending Up | Refunds Up as Tax Pros Tackle 41.5% of E-filings | Tax Pros Handle 37.7% of E-filings | Tax Pros File 33% of Early Returns

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Still, it’s a national touchpoint, so let’s take a peek at the data the IRS just released for April 19, just after the deadline.

With a later start – the 2024 filing season began on Jan. 29 vs. 2023’s Jan. 23 – it took a while for many data points to catch up. By the end of the season, though, there was only one figure lagging behind last year’s mark: the total number of direct deposit refunds.

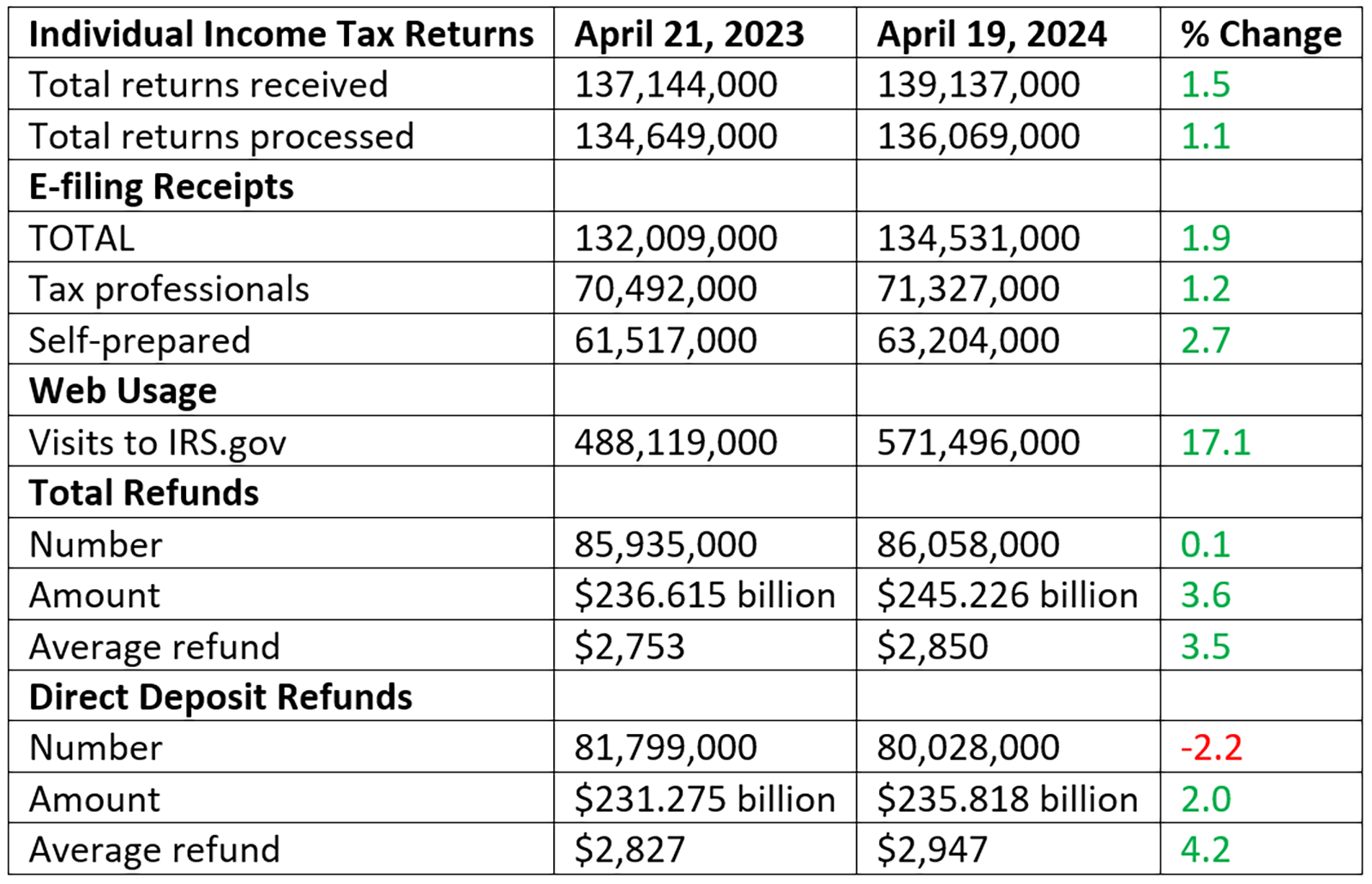

For 2024, the agency has received 139.1 million individual income tax returns, up 1.5 percent from the same period in 2023. It has processed 136 million, up 1.1 percent.

E-filings

Electronic filings at 134.5 million are up 1.9 percent.

Tax professionals are responsible for 71.3 million of those, up 1.2 percent, and self-preparers for 63.2 million, up 2.7 percent.

The tax pros’ share of the market is 53 percent. In 2023 it was 53.1 percent, and in 2022 it was 52.9 percent. (It also was 52.9 percent in 2021, but the deadline was a month later. We don’t want to think about 2020.)

Website Visits

Visits to IRS.gov at 571.5 million were up 17.1 percent.

Refunds

Total refunds numbered 86.1 million, up 0.1 percent, in the total amount of $245.2 billion, up 3.6 percent. The average refund of $2,850 was up 3.5 percent.

Direct deposit refunds numbered 80 million, down 2.2 percent, in the total amount of $235.8 billion, up 2 percent. The average direct deposit refund of $2,947 was up 4.2 percent.