Ask CPA Trendlines

Now, with smarter search, deeper analysis, more detailed responses (v.2.7).

Now, with smarter search, deeper analysis, more detailed responses (v.2.7).

Exclusively for PRO Members Only, here

By CPA Trendlines Research

The accounting profession is changing faster than at any time in its modern history—and private equity is driving the shift. More than $30 billion in new capital has entered CPA firms since 2020, igniting a powerful wave of consolidation, modernization, and strategic reinvention. Firms that once relied on incremental growth and traditional partnership structures are now operating as high-performance platforms built for scale, technology adoption, and national reach.

The CPA PE Playbook is the most comprehensive analysis available today on this historic transformation.

If you want to know where the profession is heading, how PE-backed firms are competing, and what it will take to thrive in the next decade, this is the report you need.

1,000 Deals Show Where PE Money in Accounting Really Goes.

By CPA Trendlines

Private equity’s expansion into accounting is widely framed as a takeover of public company audits. But new data shows that’s only a myth.

MORE Private Equity | The 7.6x Machine: How Grassroots Firms Are Taking Private Equity for a Ride | Deal Tracker: PE Platforms Accelerate the Grab for CPA Firms | With Apax Sale, CohnReznick Starts Building a National Platform | Unicorns and Funerals: From the Demise of Botkeeper to the Rise of Basis.ai | Jeremy Dubow: Raising the Bar for Talent | Big 4 Transparency | Twelve Great Reasons to Merge In a Smaller Accounting Firm

A close look at almost 1,000 PE deals over the last 10 years shows only about 10% involve firms with assurance practices. The reason is as clear as it is simple: The vast majority of PE and PE-backed deals are for firms too small to play in the audit business.

Understanding a company’s history, leadership, and future matters as much as financial statements.

Accounting ARC

With Donny Shimamoto

Center for Accounting Transformation

Donny Shimamoto, CPA.CITP, CGMA, opens a recent episode of Accounting ARC with a simple question: How do you value a business when the numbers tell only part of the story?

His guest, Baria Jaroudi, a Houston-based director in BDO’s business valuation and advisory practice, says valuation work requires more than reviewing financial statements. It requires understanding how owners built the business, where cash flow comes from, and what risks and assumptions shape a credible and defensible value — especially in family law and divorce matters, where the stakes can run high.

MORE Accounting ARC: Accounting’s “Untalked-About” Frontier | Why Happiness is Hard-Fought for High Achievers | The Fastest Way to Lose Talent Is “Dick Leadership” | Post-Holiday Fatigue Isn’t a Failure; It’s a Signal | OCR, Research Bots & Meeting Assistants: What Actually Helps Now | Return Season is the New Stress Test | Small Firms May Have the Biggest Advantage in 2026 | Downgraded: What the DOE Said About Accounting | Savage: Using Your License as a Megaphone | Baker: Interpreting Pricing Psychology | Don’t Get Fired by Your Own Automation | What Amazon Doesn’t Tell You | Royalties, Residuals, and Reality Checks | ARC-SLC

“I like to think of myself as someone who brings clarity and calm in moments that can otherwise feel overwhelming,” Jaroudi says.

Shimamoto, founder and managing director of IntrapriseTechKnowlogies LLC and founder and inspiration architect for the Center for Accounting Transformation, says that role reflects a core purpose of the profession: accountants deliver peace of mind. In Jaroudi’s work, that means translating complex analysis into conclusions clients can understand — and conclusions that can withstand scrutiny.

By Martin Bissett

Quick, low-cost ideas.

By Sandi Leyva

The Complete Guide to Marketing for Tax & Accounting Firms

I don’t want to stress you out, but we really do need to do something about our stress levels.

The American Psychological Association says our kids are getting headaches, having difficulty sleeping, and eating too little or too much because of pressure from school and household finances. The worst part is that most parents were not aware of the severity of their children’s stress.

READ MORE →

Fewer than 200 investors triggered almost 900 acquisitions.

By CPA Trendlines Research

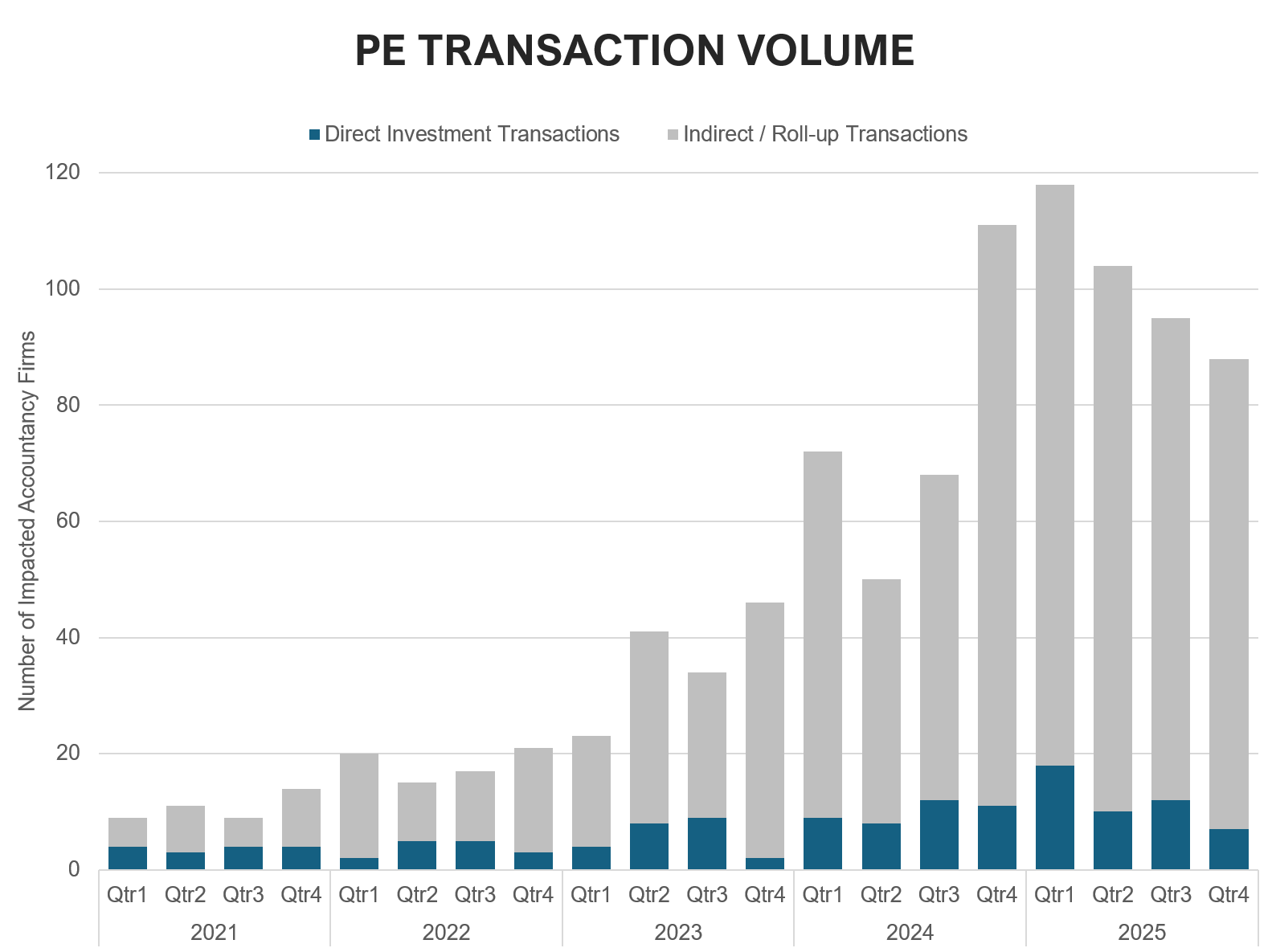

A multiplier that has grown fourfold since 2021 reveals a transformation driven not by new private equity entrants, but by platform firms consuming the mid-market at speed.

It belies the notion that PE is taking over the accounting profession. In fact, new global research argues that local and mid-size firms worldwide are taking control of their own futures and using institutional capital to pick up the tab.

MORE Private Equity | Deal Tracker: PE Platforms Accelerate the Grab for CPA Firms | With Apax Sale, CohnReznick Starts Building a National Platform | Unicorns and Funerals: From the Demise of Botkeeper to the Rise of Basis.ai | Jeremy Dubow: Raising the Bar for Talent | Big 4 Transparency | Twelve Great Reasons to Merge In a Smaller Accounting Firm

The numbers that define private equity’s advance into accounting do not look the way most people expect. The headlines feature the big firms and the brand-name investors — TowerBrook Capital and EisnerAmper, New Mountain Capital and Grant Thornton, Ares Management and Baker Tilly. But the actual architecture of the transformation is being built one level below: in the relentless, largely unnoticed roll-up of smaller practices into PE-backed platforms.